41 risk of zero coupon bonds

› 2022/10/19 › 23411972Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games. › knowledge › zero-coupon-bondZero-Coupon Bonds: Characteristics and Calculation Example Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the SP 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

Risk of zero coupon bonds

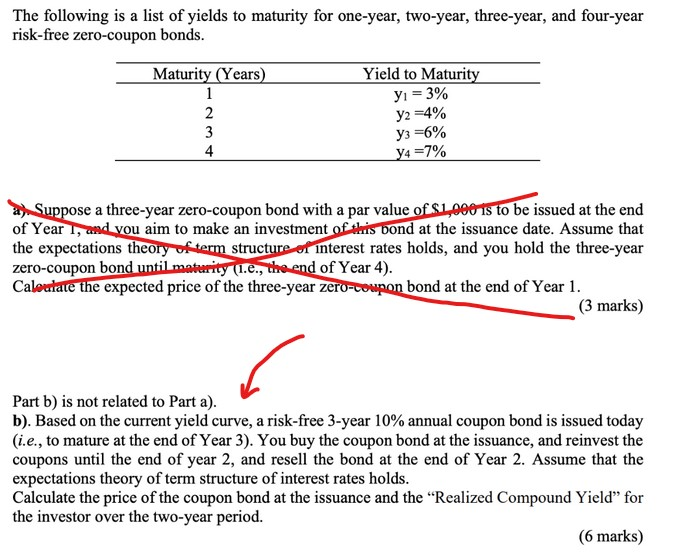

A risk-free, zero-coupon bond with a \( \$ 5,000 \) | Chegg.com A risk-free, zero-coupon bond with a $5, 000 face value has 10 years to maturity. The bond currently trades at $4, 280. What is the yield to maturity of this bond? A. 1.567% B. 85.6% C. 57.2% D. 0.784% Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... Reinvestment Risk Definition - Investopedia Zero-coupon bonds (Z-bonds) are the only type of fixed-income security to have no inherent investment risk since they issue no coupon payments throughout their lives. Key Takeaways...

Risk of zero coupon bonds. What does it mean if a bond has a zero coupon rate? - Investopedia Ariel Courage. A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this ... › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ...

› de › jobsFind Jobs in Germany: Job Search - Expatica Germany Browse our listings to find jobs in Germany for expats, including jobs for English speakers or those in your native language. What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ... › bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ... › investors › insightsThe One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk.

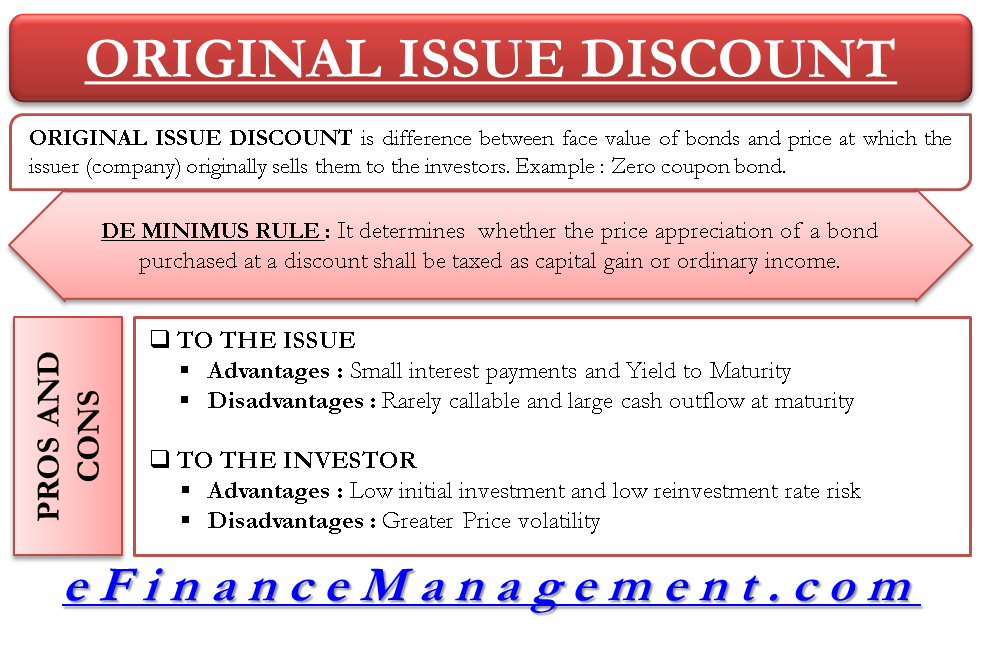

Zero-Coupon Bonds: Pros and Cons - Management Study Guide No Reinvestment Risk: Zero-coupon bonds do not have any reinvestment risk. This is because the bond does not pay interest periodically. Hence, investors do not receive any cash flow which they have to reinvest periodically. Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. ... Zero coupon bonds are particularly sensitive to interest rates, so they are also sensitive to inflation risks. Inflation ... Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Interest Rate Risk: Zero-coupon bonds that are sold before maturity are subject to interest rates risk. This is because the value of these bonds is inversely proportional to interest rates. Hence, if interest rates rise, the value of these bonds declines in the secondary market. Additionally, issuers have the option of redeeming the bond before ... Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia The zero-coupon bond has no such cushion, faces higher risk, and makes more money if the issuer survives. Zero-Coupon Bonds and Taxes Zero-coupon bonds may also appeal to investors...

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Zero-Coupon Bond - Definition, How It Works, Formula Zero-coupon bonds are the only type of fixed-income investments that are not subject to investment risk - they do not involve periodic coupon payments. Interest rate risk is the risk that an investor's bond will decline in value due to fluctuations in the interest rate.

Zero-coupon bonds news and analysis articles - Risk.net Zero-coupon bonds Original research The impact of compounding on bond pricing with alternative reference rates This paper looks at the impact of compounding on zero-coupon bond prices by considering the short rate when it follows a Gaussian diffusion process or a stochastic volatility jump-diffusion process. 12 Oct 2021 Banking

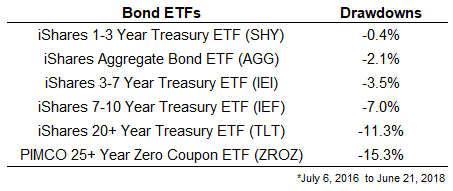

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Reinvestment Risk Definition - Investopedia Zero-coupon bonds (Z-bonds) are the only type of fixed-income security to have no inherent investment risk since they issue no coupon payments throughout their lives. Key Takeaways...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ...

A risk-free, zero-coupon bond with a \( \$ 5,000 \) | Chegg.com A risk-free, zero-coupon bond with a $5, 000 face value has 10 years to maturity. The bond currently trades at $4, 280. What is the yield to maturity of this bond? A. 1.567% B. 85.6% C. 57.2% D. 0.784%

Post a Comment for "41 risk of zero coupon bonds"