38 a 10 year bond with a 9 annual coupon

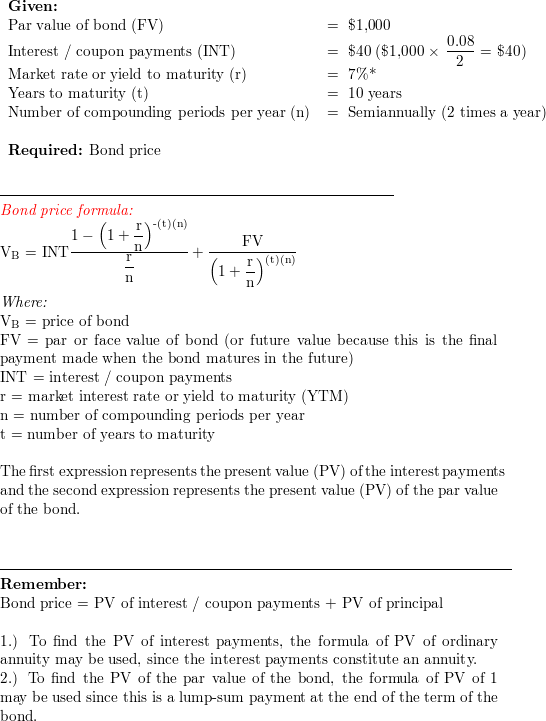

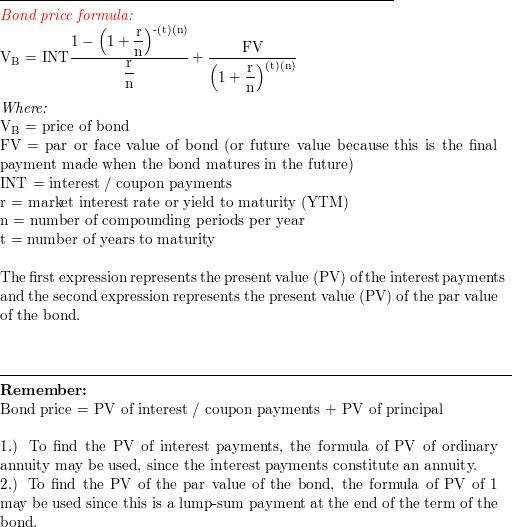

Quant Bonds - On A Coupon Date - bettersolutions.com 1) Calculate the number of coupon payments - The coupon is paid semi-annually so there will be 2 coupon payments a year, making 20 coupon payments in total. 2) Calculate the value of each coupon payment. The coupon rate will be 10/2 = 5% of the bond par value, so (1000 * 0.05) = $50. 3) Calculate the semi annual interest rate. › government › organisationsHM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

SOLVED:Consider a five-year, default-free bond with annual coupons of 5 ... VIDEO ANSWER: Consider a five-year, default-free bond with annual coupons of 5 \% and a face value of \ 1000. a. Without doing any calculations, determine whether this bond is trading at a premium or at a discount.

A 10 year bond with a 9 annual coupon

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate. Subscribe; Sign In; Menu Search. Financial Times. myFT. Search the FT Search Search ... US 10 year Treasury. Yield 4.00; Today's Change-0.017 / -0.42%; 1 Year change +153.47%; Data delayed at least 20 minutes, as of Oct 18 2022 12:29 BST. ... (Solved) - Blue Pencil Publishing has 9% annual coupon bonds that are ... 1 Answer to Blue Pencil Publishing ... home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ...

A 10 year bond with a 9 annual coupon. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Bond Valuation- Yield to maturity and yield to call - BrainMass 7-8 Bond yields: A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000, may be called in 4 years at a call price of $1,060. The bond sells for $1,100. ... Frequency = S Semi annual coupon payments Redemption (Maturity) value = $1,000 Interest payment per year= $120.00 =12.% x 1000 Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. How Does an Investor Make Money On Bonds? For instance, if you invested $1,000 in a 10-year bond with a coupon rate of 4%, the issuer would send you a coupon (interest) payment of $40 every year. Most bonds pay twice a year, so you would ...

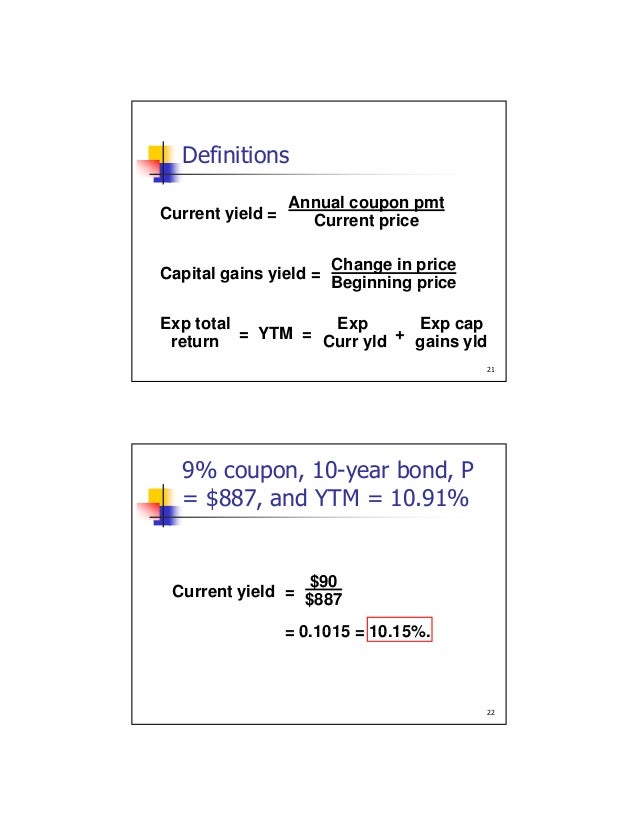

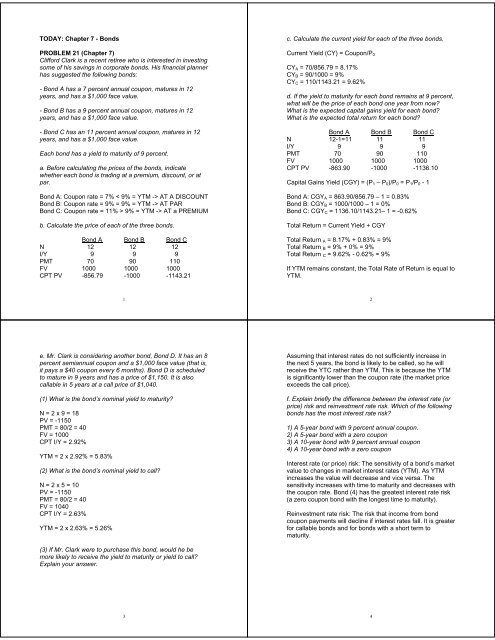

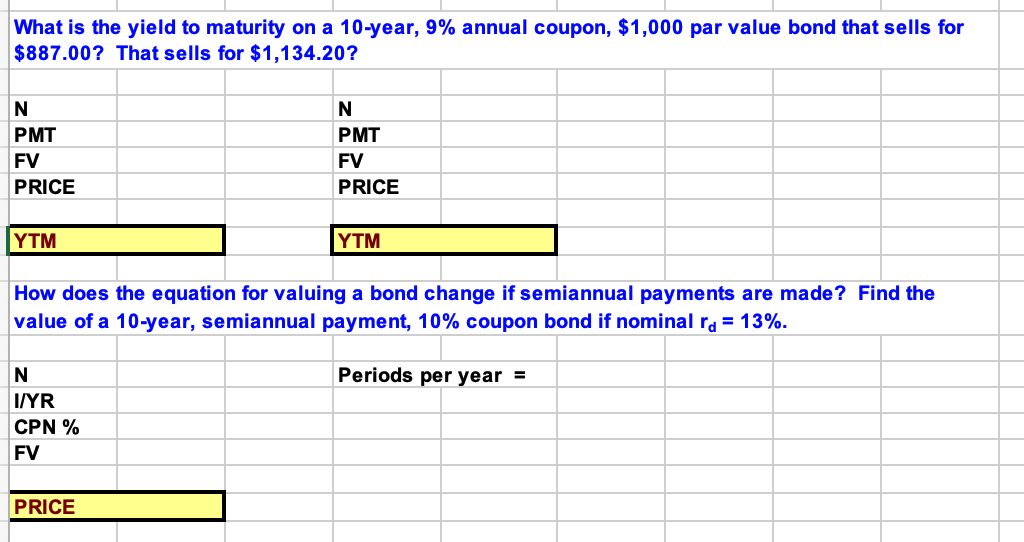

10-Year T-Note Futures Quotes - CME Group 10-Year and T-Bond Express a view on shape of the the long-end of the curve with margin offsets of up to 68%. View T-Bond Contract Specs ... auctions, coupon issuance projections, and more. STIR Analytics. View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. Total Cost Analysis. › us › productsiShares 10+ Year Investment Grade Corporate Bond ETF | IGLB Oct 18, 2022 · The iShares 10+ Year Investment Grade Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated investment-grade corporate bonds with remaining maturities greater than ten years. Yield to maturity calculations for bonds - BrainMass Years to Mat: 10 Coupon rate: 9% Annual Pmt: $90.00 Going rate, r =YTM: 10.91% See RATE function at right. Current price: $887.00 (2.) What are the total return, the current yield, and the capital gains yield for the discount bond? (Assume the bond is held to maturity and the company does not default on the bond.) Current and Capital Gains Yields › 10-year-treasury-note10-Year Treasury Note and How It Works - The Balance Mar 24, 2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ...

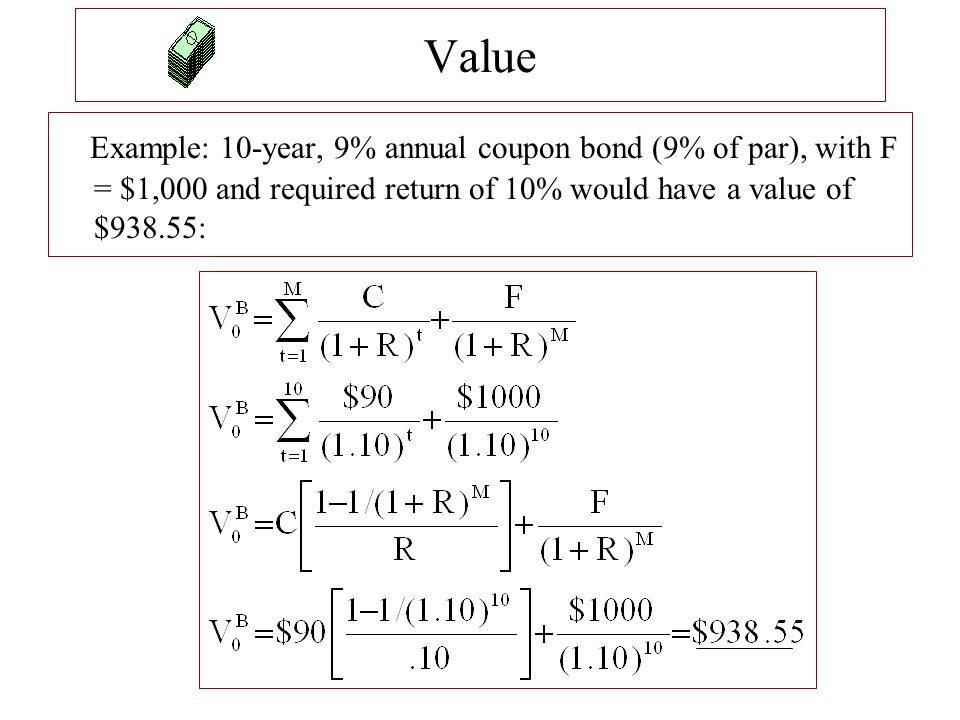

United States 10 Years Bond - Historical Data - World Government Bonds Historical Data. Data Source: from 30 Apr 2007 to 16 Oct 2022. The United States 10 Years Government Bond reached a maximum yield of 5.297% (12 June 2007) and a minimum yield of 0.512% (4 August 2020). Netherlands 10 Years Bond - Historical Data - World Government Bonds The Netherlands 10 Years Government Bond has a 2.678% yield. Click on Spread value for the historical serie. A positive spread, marked by , means that the 10 Years Bond Yield is higher than the corresponding foreign bond. Instead, a negative spread is marked by a green circle. Click on the values in " Current Spread " column, for the historical ... A bond has 10 years until maturity, carries a coupon rate of...ask 1 Answer of A bond has 10 years until maturity, carries a coupon rate of 9%, and sells for $1,100. Interest is paid annually. (LO6-2 and LO6-3) a. If the bond has... Yield to Maturity Calculator | Calculate YTM In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity. The n is the number of years from now until the bond matures. The n for Bond A is 10 years. Calculate the bond YTM. The YTM can be seen as the internal rate of return ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

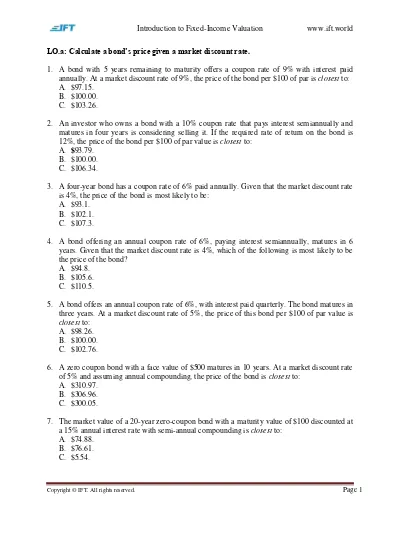

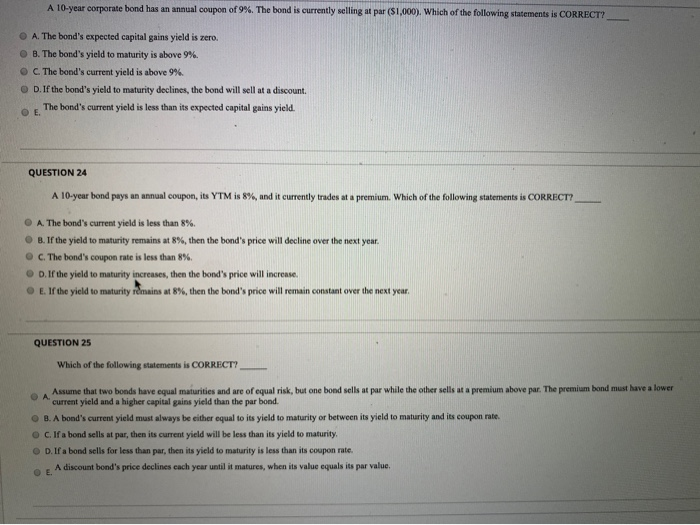

a 10-year bond pays an annual coupon, its ytm is 8%, and it currently ... a 10-year bond pays an annual coupon, its ytm is 8%, and it currently trades at a premium. which of the following statements is correct? W Th A 10-year bond pays an annual coupon, its YTM is 8%, and it currently trades at a premium. Which of …

How to get 9.62% annual interest for Series I bonds before November While I bond rates shift twice yearly based on inflation, you can still lock in 9.62% annual interest for six months — as long as you complete the purchase by Oct. 28. And six months after your ...

› coupon-bond-formulaCoupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 – (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps:

› investing › bondTMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Oct 17, 2022 · Ireland 10 Year Government Bond: 0.723: 2.814%: Belgium 10 Year Government Bond: 0.709: 2.922%: France 10 Year Government Bond: 0.814: 2.857%: Portugal 10 Year Government Bond: 0.636: 3.338% ...

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ September 24th, 2022 by. PK. The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. (If you are looking for a similar calculator for the S&P 500 ...

› 2016 › 10-year-treasury-bond10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of October 18, 2022 is 4.01%.

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ...

(Solved) - Blue Pencil Publishing has 9% annual coupon bonds that are ... 1 Answer to Blue Pencil Publishing ...

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate. Subscribe; Sign In; Menu Search. Financial Times. myFT. Search the FT Search Search ... US 10 year Treasury. Yield 4.00; Today's Change-0.017 / -0.42%; 1 Year change +153.47%; Data delayed at least 20 minutes, as of Oct 18 2022 12:29 BST. ...

Post a Comment for "38 a 10 year bond with a 9 annual coupon"