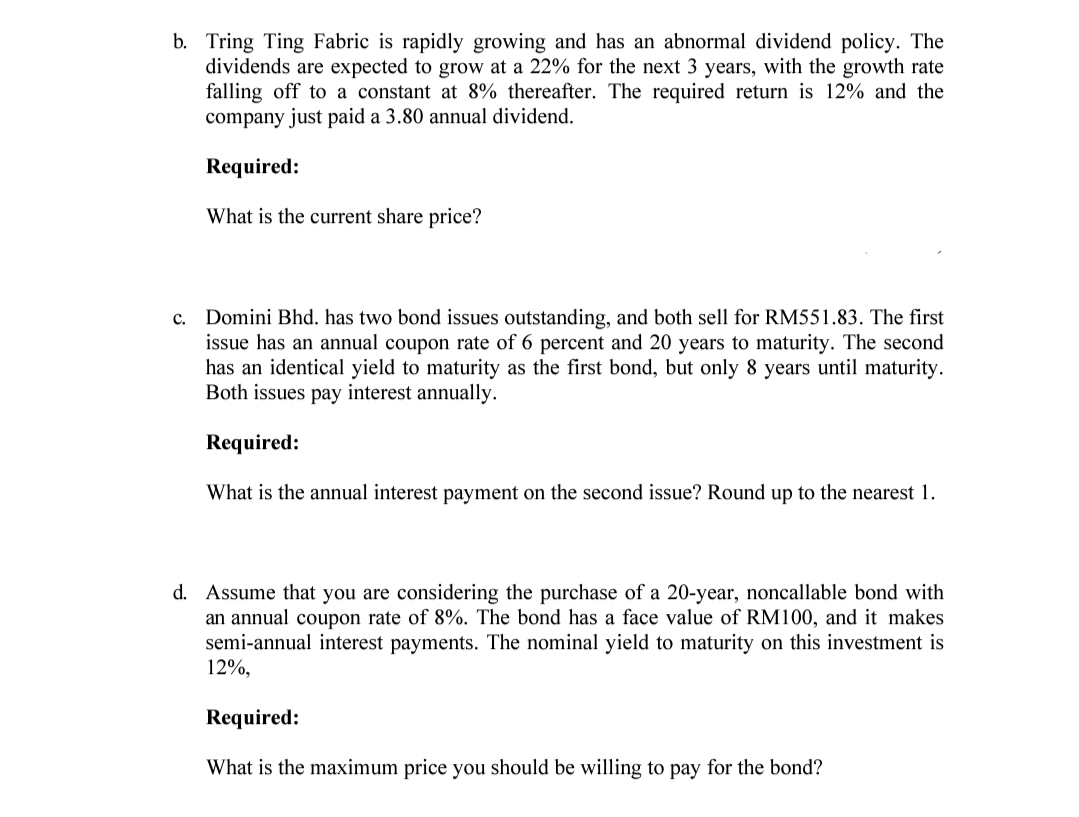

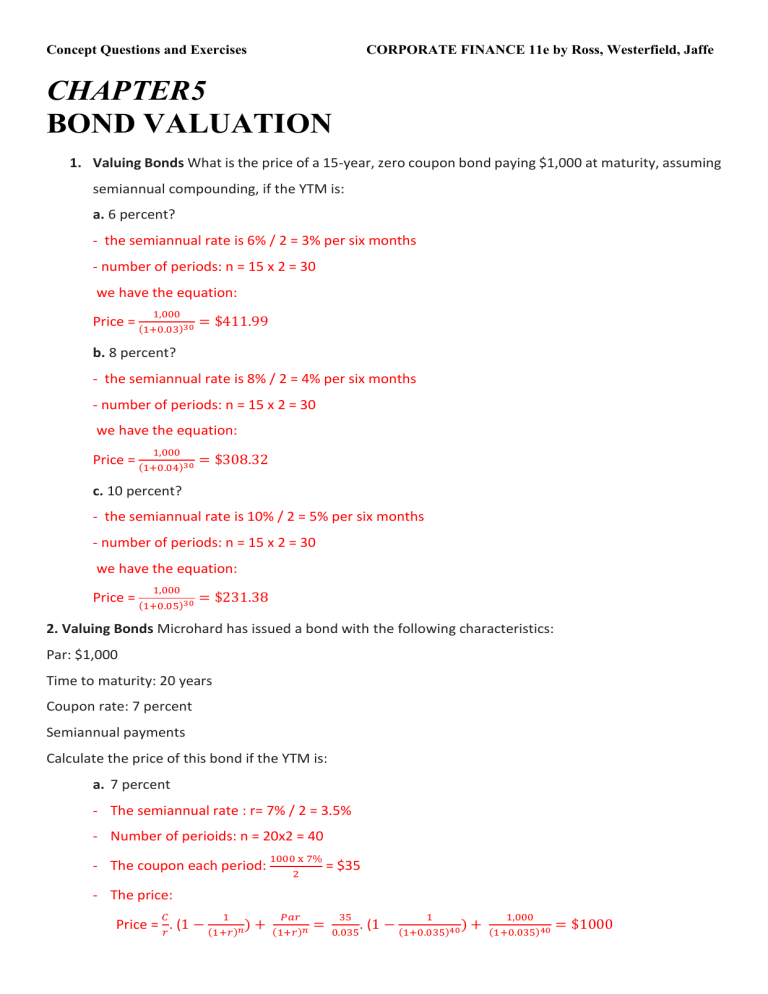

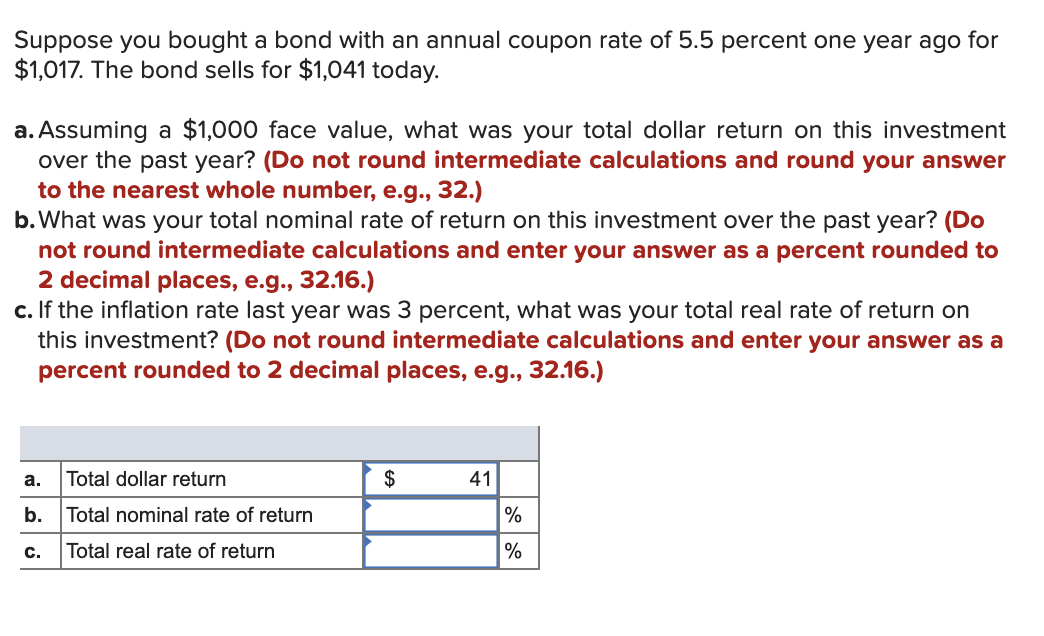

44 suppose you bought a bond with an annual coupon of 7 percent

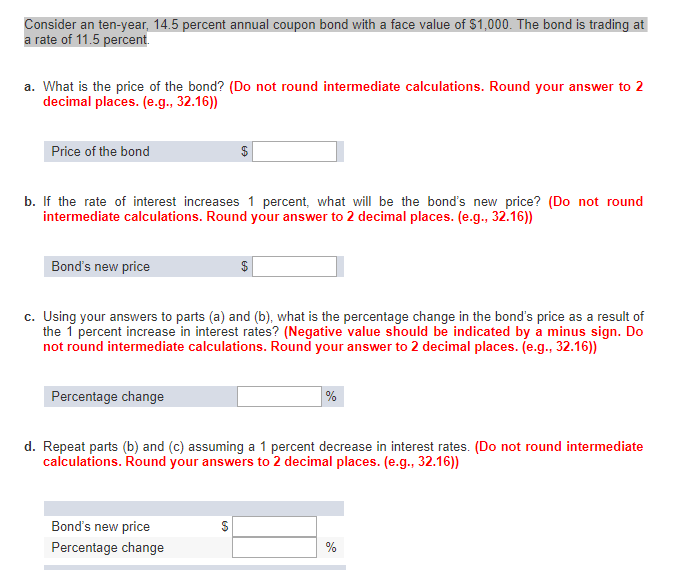

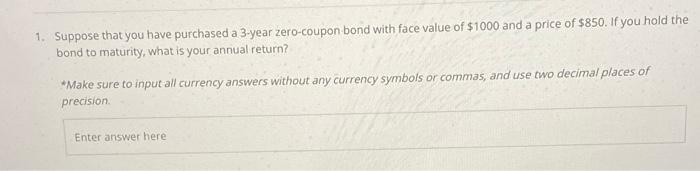

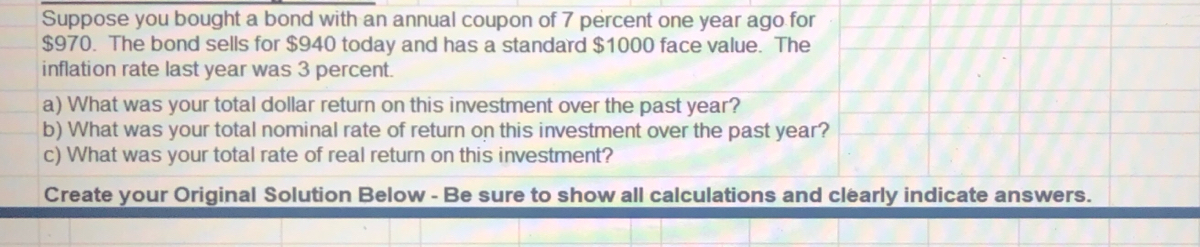

Solved Suppose you bought a bond with an annual coupon of 7 | Chegg.com Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today. a. Assuming a $1,000 face value, what was you total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c. Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

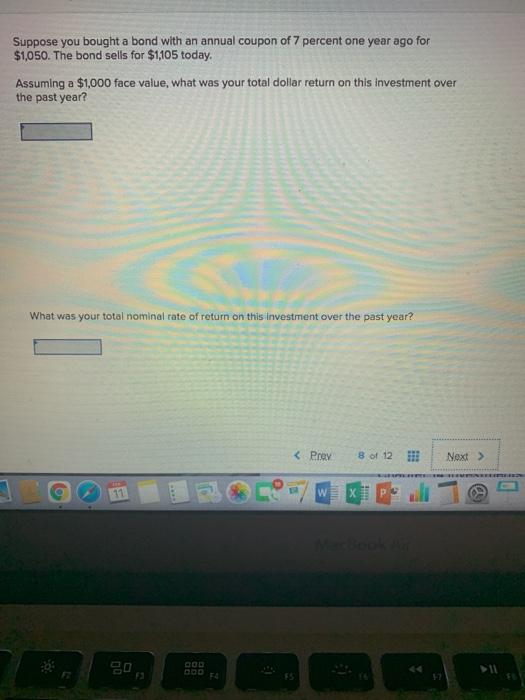

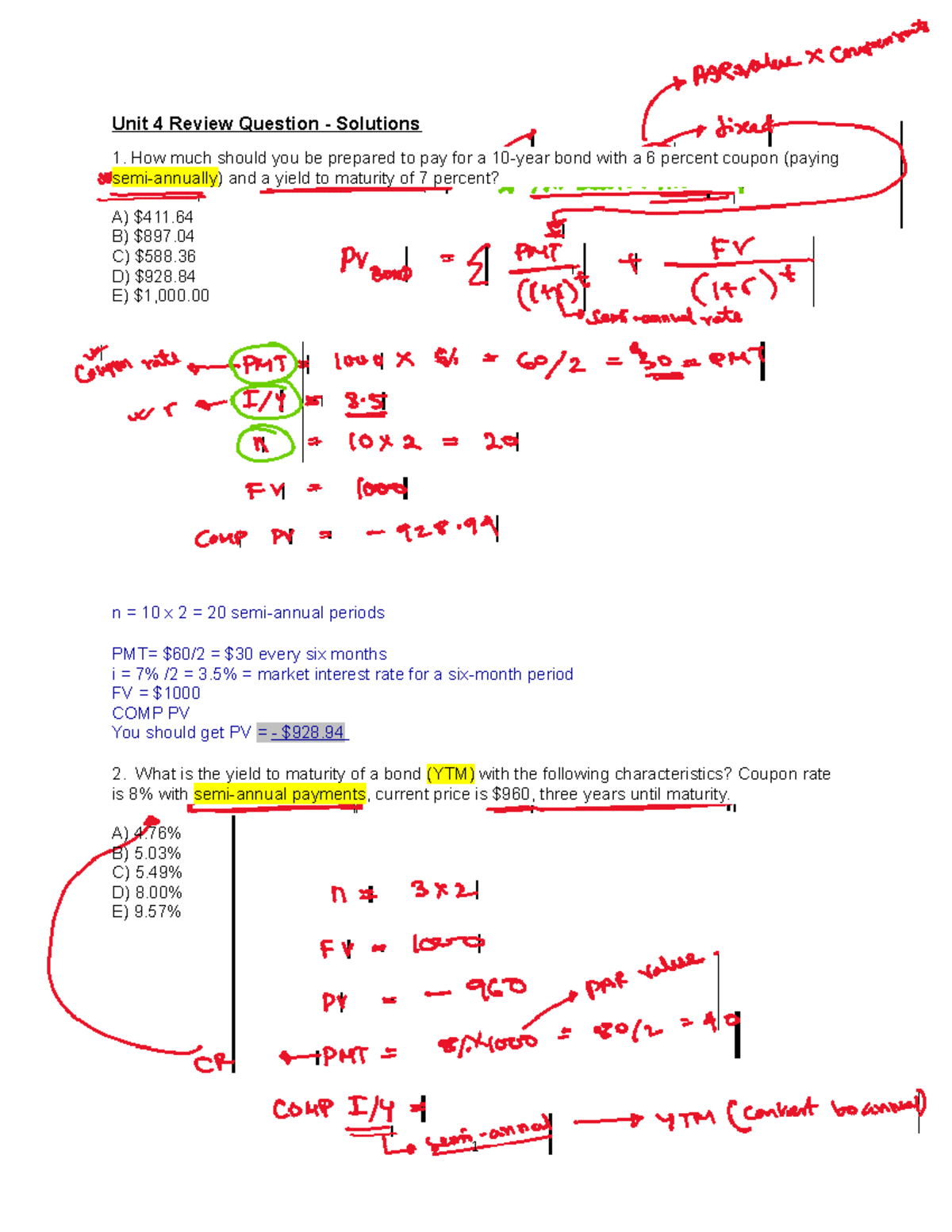

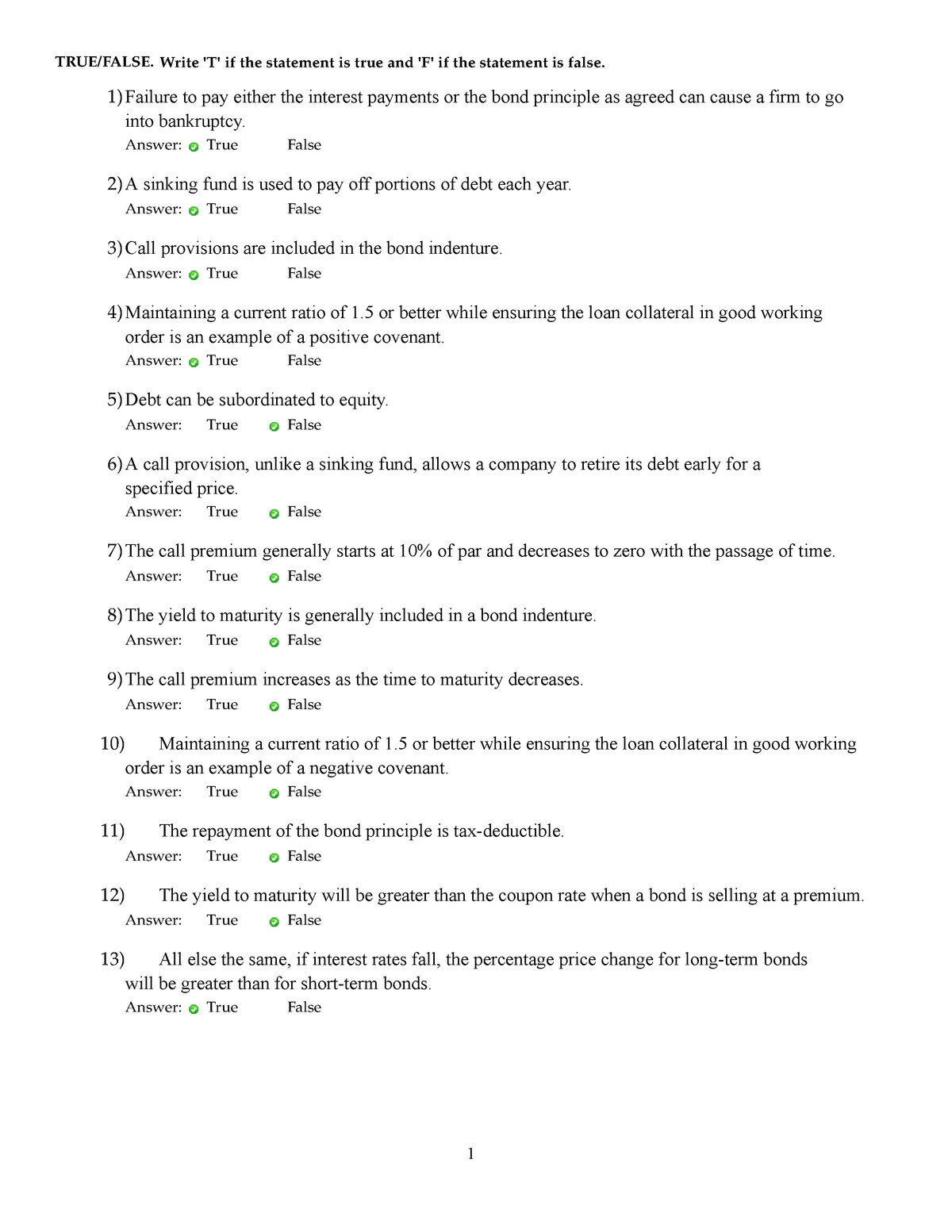

Fin 311 Homework Questions 1 - 1. Suppose you buy a 7 percent coupon ... Suppose that today you buy a 7 percent annual coupon bond for $1,060. The bond has 10 years to maturity. You expect to earn a rate of percent on your investment. (Do not include the percent sign (%). Round your answer to 2decimal places. (e.g., 32.16)) b. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell.

Suppose you bought a bond with an annual coupon of 7 percent

Question : Question Suppose you buy a 7 percent annual coupon bond ... Suppose you buy a 7 percent annual coupon bond today for $960.The bond has 6 years to maturity. The face value of the bond is$1,000. What is the YTM of the bond? Assume that your investmenthorizon is equal to the duration of the bond. Two years from now,the YTM on your bond has decreased by 50 basis points. Answered: Suppose you buy a bond with a coupon of… | bartleby Business Finance Q&A Library SOLVED: Suppose you bought a five-year zero-coupon Treasury bond for ... SOLVED: Suppose you bought a five-year zero-coupon Treasury bond for $800 per $1000 face value. Assume the yield to maturity on comparable bonds increases to 7% after you purchase the bond and remains there. Calculate your holding period return (annual return) if you sell the bond after one year. LC Lawrence C. Placeholder 6 months, 1 week ago

Suppose you bought a bond with an annual coupon of 7 percent. Suppose you bought a bond with an annual coupon rate of 7.5 percent one ... Suppose you bought a bond with an annual coupon rate of 7.5 percent one year ago for $898. The bond sells for $928 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year rbig8379 is waiting for your help. Add your answer and earn points. Expert-verified answer Parrain Answer: $105 Answered: 4. Calculating Returns [LO1] Suppose… | bartleby Solution for 4. Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today.… Answered: Another nice gentleman emails you to… | bartleby After the disappointment of how much you would need to save each month in Question 6 to achieve your original dream, you feel like your luck has turned back around. You now just have to decide if you would like your winnings paid out in a lump sum of $500,000 or receive annual end of year payments of $33,000 for 20 years. Question : Question Suppose you bought a bond with an annual coupon ... Suppose you bought a bond with an annual coupon rate of 8 percent one year ago for $903. The bond sells for $938 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

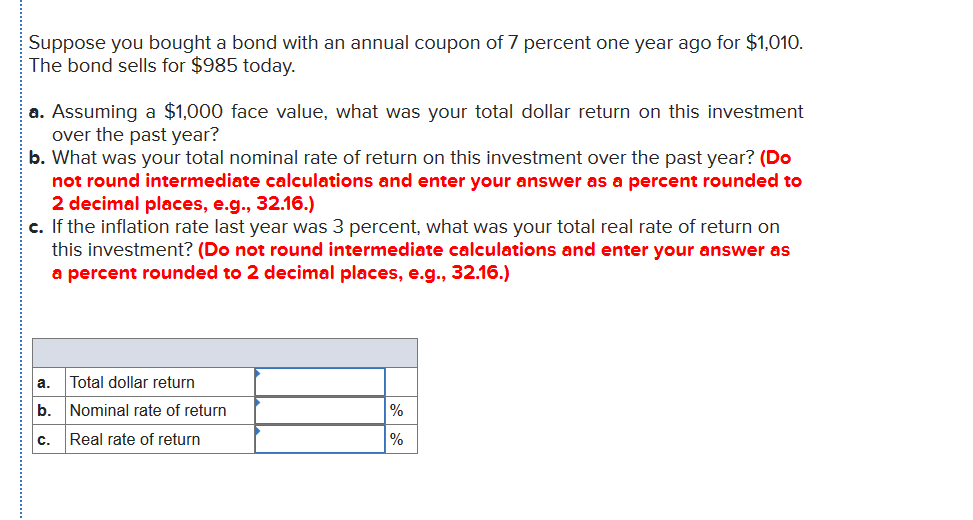

Answered: Suppose you buy a 7 percent coupon,… | bartleby arrow_forward. Suppose you purchase a $1,000 bond with a coupon rate of 8% matures in 5 years at par, and you plan to sell it at the end of 3 years at the prevailing market price. When you purchase the bond, your investment advisor predicts that similar bonds with 2 years to maturity yield at 6%. Suppose you bought a bond with an annual coupon of - SolutionInn Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c. Chapter 7: Interest Rates and Bond Valuation - Quizlet The yield-to-maturity on a bond is the interest rate you earn on your investment if interest rates do not change. If you actually sell the bond before it matures, your realized return is known as the holding period yield. Suppose that today you buy a 9 percent annual coupon bond for $1,000. The bond has 12 years to maturity. Suppose you bought a bond with an annual coupon of 7 percent Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. Subject: Business Price: 2.87 Bought 7. Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year?

AHIP- MEDICARE (Module 2 - Plans) 2019 Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Which statement best describes PACE plans? Choose one answer. a. It is an all-inclusive Medicare plan widely available throughout the United States. b. It includes comprehensive medical and social service delivery systems using an interdisciplinary team approach in an adult day health center, supplemented by in-home and referral ... Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a.Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b.What was your total nominal rate of return on this investment over the past year? (Solved) - Interpreting Bond Yields. Suppose you buy a 7 percent coupon ... Suppose you buy a 7 percent ... FRL 300 Final Ch 7 Flashcards | Quizlet If you actually sell the bond before it matures, your realized return is known as the holding period yield. Suppose that today, you buy a 12 percent annual coupon bond for $1,000. The bond has 13 years to maturity. Two years from now, the yield-to-maturity has declined to 11 percent and you decide to sell.

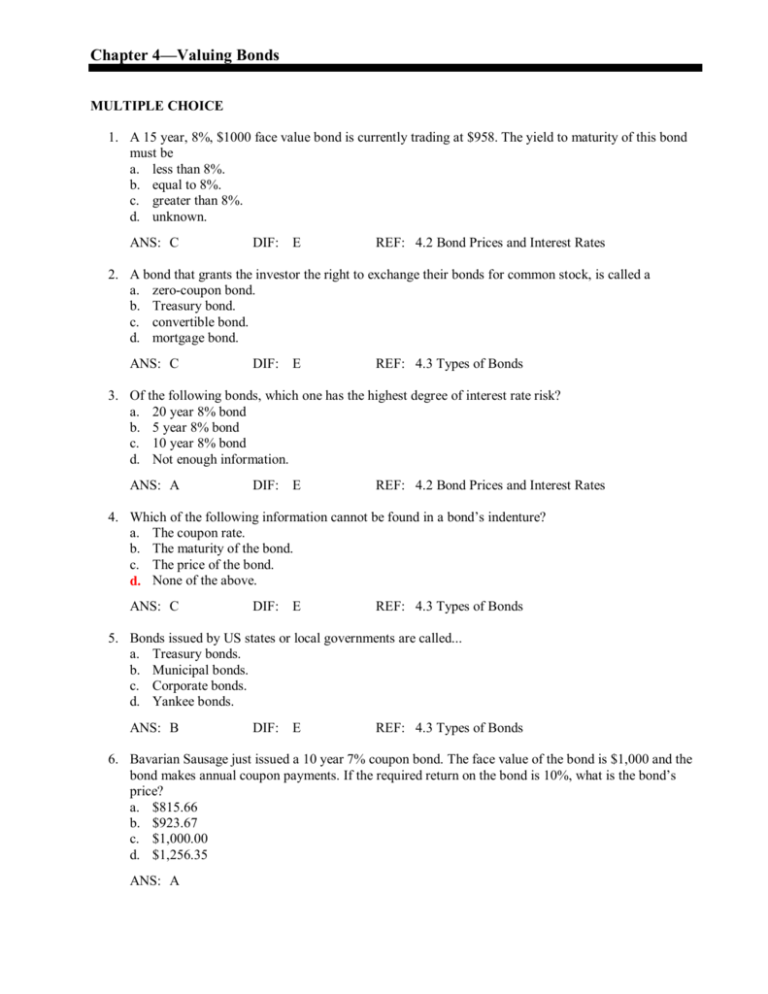

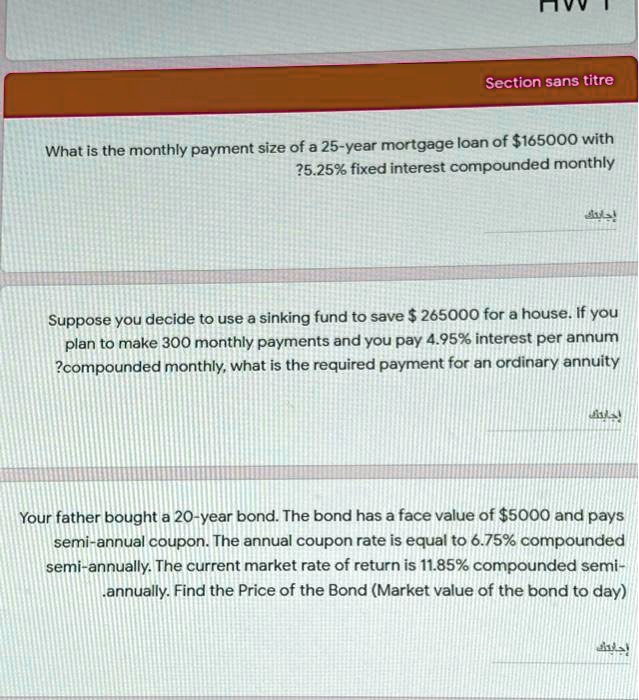

Chapter 7 Homework.docx - 2- Suppose you buy a 7 percent... 2- Suppose you buy a 7 percent coupon, 20-year bond today when it's first issued. If interest rates suddenly rise to 15 percent, what happens to the value of your bond? Why? - The value of the bond goes down because of the worth and rate of interest don't go together. The 7 percent coupon is fixed, and it will lose value as interest rates go up.

Financial Capital and Health Care Growth Trends - For-Profit ... By contrast, if the firm had raised $40 of financing by selling newly issued bonds that pay bondholders an annual coupon-interest rate of, say, 10 percent, and if the firm faced a profit tax of 46 percent, then its annual after-tax cost of debt financing would be only (1-0.46)(0.10)$40 = $2.16 per $40 of debt financing, or 5.4 percent per year.

Assignment 2.4.xlsx - Chapter 12 - Dropbox 2.4 Problem 1:... Purchase price a year ago = $970 Current bond price = $940 Annual coupon rate = 7% Face value = $1,000 Inflation rate last year = 3% With this information, we proceed with the calculation of the required. a) Total dollar return: = Current bond price - Purchase price a year ago + annual coupon = $940 - $970 + ($1,000 * 0.07) = -$30 + $70 = $40

Chapter 10 Finance Flashcards | Quizlet To calculate the dollar return, we multiply the number of shares owned by the change in price per share and the dividend per share received. The total dollar return is: Dollar return = 270 ($82.84 - 76.33 + 1.45) Dollar return = $2,149.20 Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901.

Answered: ed to Checkpoint 9.2) (Yield to … | bartleby A: Data given: Par value of the bond = $1000 N= 28 years Coupon rate = 8.0% with semi-annual payments… Q: Finance Suppose you bought a put option with a strike price of $21 for $4. What would be your payoff…

Answered: Suppose you bought a bond with an… | bartleby Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901. The bond sells for $934 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b.

Solved Suppose you bought a bond with a coupon rate of 7.9 - Chegg Suppose you bought a bond with a coupon rate of 7.9 percent one year ago for $902. The bond sells for $936 today. Required: (a) Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? Total dollar return $ (b) What was your total nominal rate of return on this investment over the past year?

Chapter 7, Interest Rates and Bond Valuation Video Solutions ... a. Suppose that today you buy a 9 percent coupon bond making annual payments for $\$ 1,150 .$ The bond has 10 years to maturity. What rate of return do you expect to earn on your investment? b. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell. What price will your bond sell for?

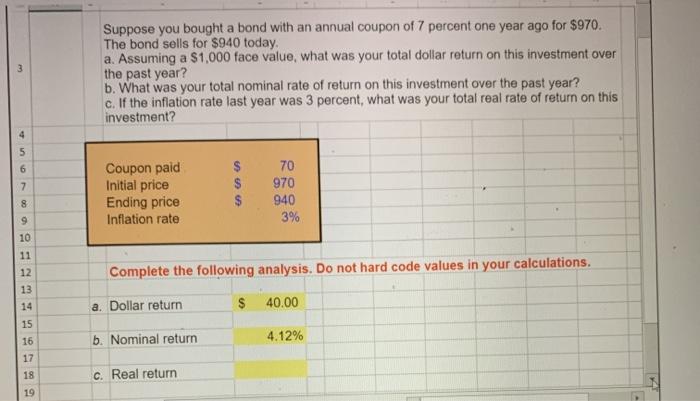

Answered: 4. Calculating Returns [LO1] Suppose… | bartleby Calculating Returns [LO1] Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? c.

INVESTMENTS 1 - CHAPTER 11 Flashcards | Quizlet Suppose you sell the 10-year, A-rated 7 percent bonds you own, which are yielding 8 percent, and replace them with an equal amount of 10-year, A-rated 8 percent bonds that are priced to yield 9 percent. In this situation, you are executing A) an immunization deal. B) a yield pickup swap. C) a laddered bid. D) a spread bid.

Calculating returns suppose you bought a bond with an - Course Hero Calculating Returns Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year?

Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year?

Chapter 7 Interest Rates And Bond Valuation - Quizlet Sunset Sales has 7.2 percent coupon bonds on the market with 11 years left to maturity. The bonds make semiannual payments and currently sell for 98.6 percent of par. ... Suppose that today you buy a 9 percent annual coupon bond for $1,000. The bond has 12 years to maturity. Three years from now, the yield-to-maturity has declined to 7 percent ...

Solved Suppose you bought a bond with an annual coupon of 7 - Chegg Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? (Do not round intermediate calculations

ch 7.8.docx - Suppose you buy a 7 percent coupon, 20-year bond today ... Suppose you buy a 7 percent coupon, 20-year bond today when it's first issued. If interest rates suddenly rise to 15 percent, what happensto the value of your bond? the price of the bond will fall Explanation: Price and yield move in opposite directions; if interest rates rise, the price of the bond will fall.

Purchasing Power Parity Formula | Calculator (Excel Template) Suppose US dollar is equal to 60 Indian rupees. ( 1$ = 60). Now, consider that an American visited India for the first time. He purchased ten cupcakes for Rs 120. He found the cupcakes cheaper here, as in the US, he had bought similar cupcakes for $3. So here, $3 = 180. For Rs 180, he would be able to buy 15 cupcakes in India.

SOLVED: Suppose you bought a five-year zero-coupon Treasury bond for ... SOLVED: Suppose you bought a five-year zero-coupon Treasury bond for $800 per $1000 face value. Assume the yield to maturity on comparable bonds increases to 7% after you purchase the bond and remains there. Calculate your holding period return (annual return) if you sell the bond after one year. LC Lawrence C. Placeholder 6 months, 1 week ago

Answered: Suppose you buy a bond with a coupon of… | bartleby Business Finance Q&A Library

Question : Question Suppose you buy a 7 percent annual coupon bond ... Suppose you buy a 7 percent annual coupon bond today for $960.The bond has 6 years to maturity. The face value of the bond is$1,000. What is the YTM of the bond? Assume that your investmenthorizon is equal to the duration of the bond. Two years from now,the YTM on your bond has decreased by 50 basis points.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

![Answered: 4. Calculating Returns [LO1] Suppose… | bartleby](https://content.bartleby.com/qna-images/question/4ed9bdea-3a41-49ec-a684-f00d4b6b8d3d/8fd2ac2f-5447-46a5-acf3-3441dc616c9a/0aq6elm.png)

![Bond Yield: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/11180917/Bond-Yield-Metrics-e1644621656277.jpg)

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula.jpg)

Post a Comment for "44 suppose you bought a bond with an annual coupon of 7 percent"