42 zero coupon bond accrued interest

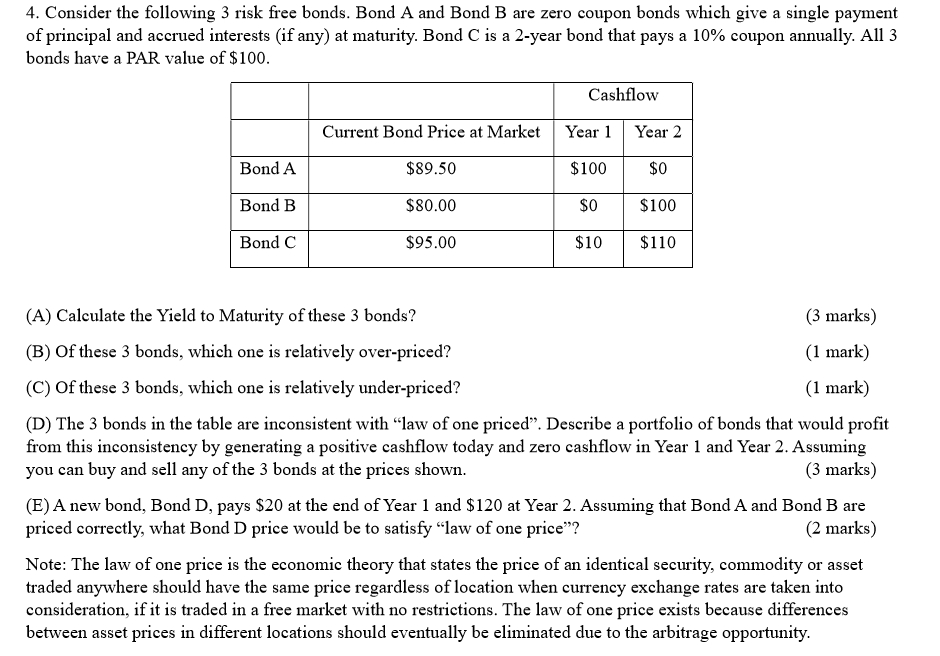

Calculate Accrued Interest Zero Coupon Bond Calculate Accrued Interest Zero Coupon Bond. 4 seconds ago. 0 0 Less than a minute. calculate zero coupon bond accrued interest ... en.wikipedia.org › wiki › Dirty_priceDirty price - Wikipedia To avoid the impact of the next coupon payment on the price of a bond, this cash flow is excluded from the price of the bond and is called the accrued interest. In finance , the dirty price is the price of a bond including any interest that has accrued since issue of the most recent coupon payment.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate 3. The compounding of this interest raises the principal by $1,068 from $17,800 to $18,868. The balances to be reported in the financial statements at the end of Year One are as follows: Year One—Interest Expense (Income Statement) $1,068.

Zero coupon bond accrued interest

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ... Accrued Interest | What It Is and How It's Calculated - Annuity.org For example, a zero-coupon bond maturing in 10 years and paying 4 percent interest would sell for approximately $6,755. Over the course of the next 10 years, the remaining $3,245 would accrue gradually until the bond matured, at which time the investor would be paid the full $10,000. Tax Considerations for Zero Coupon Bonds - Financial Web Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement. It can, of course, be difficult for some ...

Zero coupon bond accrued interest. Zero-Coupon Bonds: Pros and Cons - Management Study Guide Taxation on Phantom Interest: Zero-coupon bonds do not pay any interest to investors. However, the interest does accrue over the years. ... Hence, most governments across the world will charge tax immediately based on the amount of interest accrued. This becomes a double whammy for the investors. Firstly, investors are not paid any money ... › news › mcminisWhat are zero-coupon bonds? - moneycontrol.com Sep 07, 2022 · Zero coupon bonds are issued at a discount to the face value of the bond. They do not pay interest during the tenure of the security. The investor of the zero coupon bond receives the face value ... › articles › investingHow to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · Since the last coupon was issued, there have been 119 days of accrued interest. Thus the accrued interest = 5 x (119 ÷ (365 ÷ 2) ) = 3.2603. The Bottom Line corporatefinanceinstitute.com › imputed-interestImputed Interest - Overview, Calculation, Tax Implications May 18, 2021 · In filing tax returns, zero-coupon bonds are required to declare the imputed interest. The imputed interest for the year on zero-coupon bonds is estimated as the accrued interest rather than the minimum interest like in below-market loans. It is calculated as the yield to maturity (YTM) multiplied by the present value of the bond. The value of ...

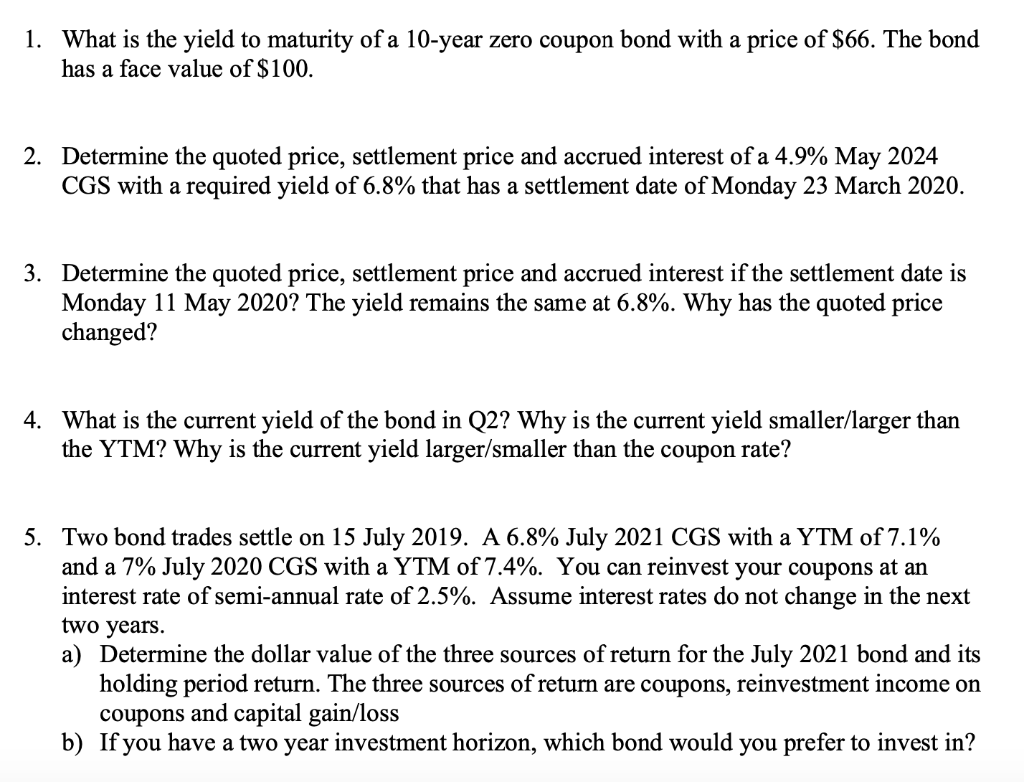

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Accrual Bond Definition - Investopedia Accrual Bond: A bond that does not pay periodic interest payments. Instead, interest is added to the principal balance of the bond and is either paid at maturity or, at some point, the bond begins ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. › bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3. What does it mean if a bond has a zero coupon rate? - Investopedia Ariel Courage. A bond's coupon rate is the percentage of its face value payable as interest each year. A bond with a coupon rate of zero, therefore, is one that pays no interest. However, this ... Accrued Interest - Bond Dirty Price vs. Clean Price - GlynHolton.com On each ex-coupon date, the accrued interest drops to a very slightly negative value before gradually rising again. Of course, if a bond trade settles exactly on the coupon date, you don't use either formula [2] or [3]. There is zero accrued interest, and the dirty price equals the clean price. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

EOF

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified ...

dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Zero coupon Bonds — Quicken September 1. For background, zero coupon bonds are purchased at steep discount to face value. Interest is earned on the bond and is paid at maturity when the bond is reddened at face value. To record this in quicken requires 3 transactions; 1) An Interest Income transaction - for the amount of interest, 2) A negative Return Of Capital ...

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep On the date of maturity - when the zero-coupon bond "comes due" - the bondholder is entitled to receive a lump-sum payment equal to the initial investment amount plus the accrued interest. Therefore, zero-coupon bonds consist of just two cash flows: Purchase Price: The bond's market price on the date of purchase (cash inflow to ...

Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Tax Considerations for Zero Coupon Bonds - Financial Web Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement. It can, of course, be difficult for some ...

Accrued Interest | What It Is and How It's Calculated - Annuity.org For example, a zero-coupon bond maturing in 10 years and paying 4 percent interest would sell for approximately $6,755. Over the course of the next 10 years, the remaining $3,245 would accrue gradually until the bond matured, at which time the investor would be paid the full $10,000.

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

Post a Comment for "42 zero coupon bond accrued interest"