41 yield to maturity coupon bond

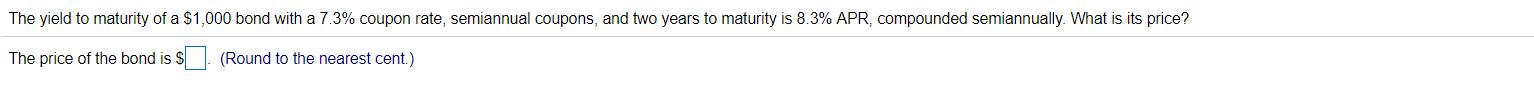

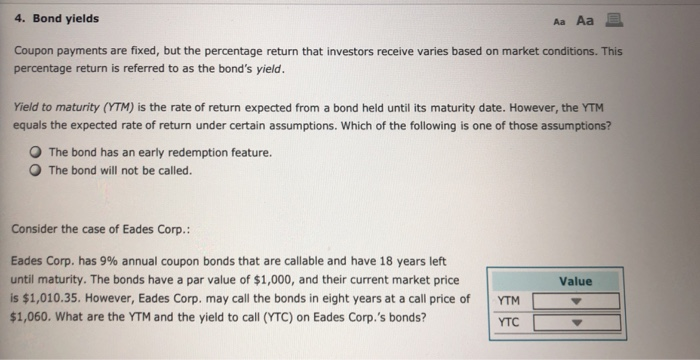

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? Aug 22, 2021 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... online-calculator.org › yield-to-maturityYield to Maturity Calculator (YTM Calculator) - YTM Formula Yield to Maturity Formula. The calculation of yield to maturity is quiet complicated, here is a yield to maturity formula to estimate the yield to maturity. Yield to Maturity (YTM) = (C+(F-P)/n)/(F+P)/2, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity. How to Calculate Yield to Maturity

studyfinance.com › yield-to-maturityYield to Maturity | Formula, Examples, Conclusion, Calculator Apr 12, 2022 · Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond’s yield in terms of its current market price and looks at the effective yield of a bond based on compounding.

Yield to maturity coupon bond

› knowledge-center › what-is-theWhat Is the Difference Between IRR and the Yield to Maturity ... Mar 27, 2019 · Yield to maturity The biggest difference between IRR and yield to maturity is that the latter is talking about investments that ... The bond's face value is $1,000 and its coupon rate is 6%, so we ... › terms › yYield to Maturity (YTM) Definition - investopedia.com Sep 06, 2021 · Yield to Maturity (YTM) Summary . A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon ... › Zero-Coupon-BondZero Coupon Bond Yield - Formula (with Calculator) For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. Although no coupons are paid periodically, the investor will receive the return upon maturity or upon sell assuming that the rates remain constant. Zero Coupon Bond Effective Yield Formula vs. BEY Formula. The zero coupon bond effective ...

Yield to maturity coupon bond. › Zero-Coupon-BondZero Coupon Bond Yield - Formula (with Calculator) For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. Although no coupons are paid periodically, the investor will receive the return upon maturity or upon sell assuming that the rates remain constant. Zero Coupon Bond Effective Yield Formula vs. BEY Formula. The zero coupon bond effective ... › terms › yYield to Maturity (YTM) Definition - investopedia.com Sep 06, 2021 · Yield to Maturity (YTM) Summary . A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon ... › knowledge-center › what-is-theWhat Is the Difference Between IRR and the Yield to Maturity ... Mar 27, 2019 · Yield to maturity The biggest difference between IRR and yield to maturity is that the latter is talking about investments that ... The bond's face value is $1,000 and its coupon rate is 6%, so we ...

What is the yield to maturity of a five-year, $5,000 bond with a 4.4 % coupon rate... - HomeworkLib

[Solved] What is the yield to maturity of the following bond? coupon 9% maturity date 2027 ...

/165642901-56a0b1833df78cafdaa409a4.jpg)

Post a Comment for "41 yield to maturity coupon bond"