40 yield to maturity of zero coupon bond

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ...

Agssignment 1 A 9 percent Coupon bond issued by the state ... Agssignment 1A 9 percent Coupon bond issued by the state of Pennsylvania sells for $ 1000 and thus provides a 9 percent yield to maturity. What on a Synthetic Chemical Company Bond would cause the two bonds to provide the same after-tax rate of return to an investor in the 28 percent tax bracket?Assignment 2Micromain Company has 10,000,000 shares of common stock authorized and 8,000,000 shares ...

Yield to maturity of zero coupon bond

FIN: Ch. 6 (Test 2) Flashcards - Quizlet C) The yield to maturity for a zero-coupon bond is the return you will earn as an investor from holding the bond to maturity and receiving the promised face value payment. D) When prices are quoted in the bond market, they are conventionally quoted in increments of $1,000. D Recommended textbook explanations Principles of Economics money.usnews.com › how-bond-maturity-worksHow Bond Maturity Works | Bonds | US News Mar 12, 2020 · A savings bond is an example of a zero-coupon bond because the interest payments are added to the bond's principal value, rather than paid out periodically. Holders can check savings bond maturity ... Yield to Maturity | Formula, Examples, Conclusion, Calculator 12.4.2022 · Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond’s yield in terms of its current market price and looks at the effective yield of a bond based on compounding.

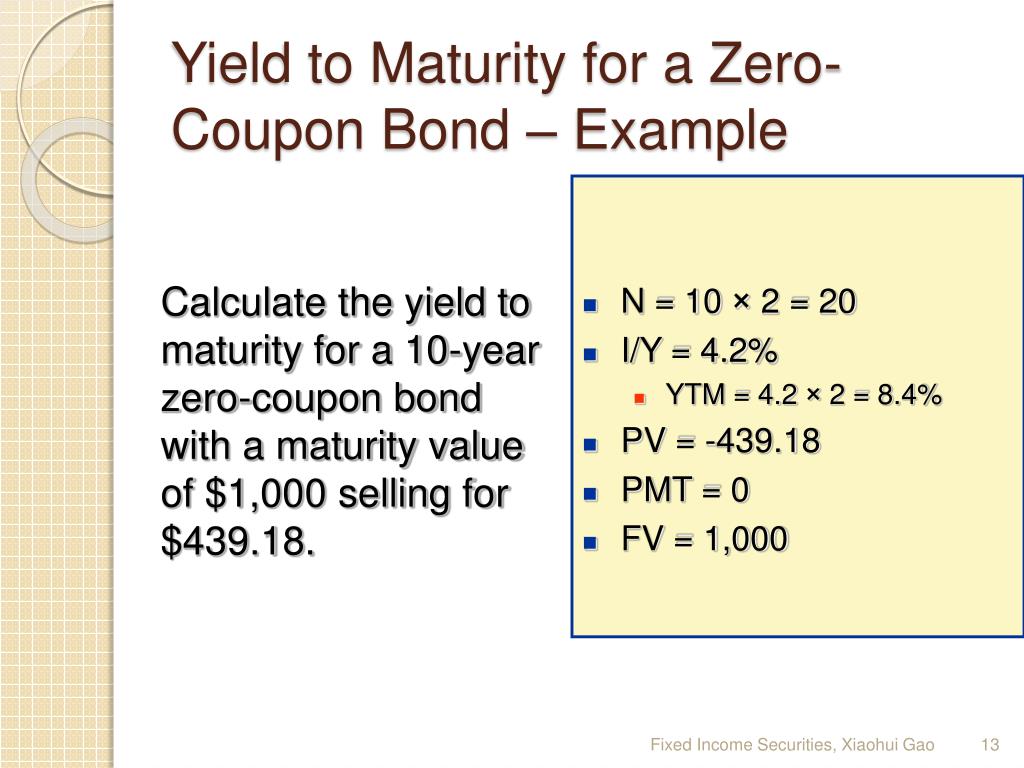

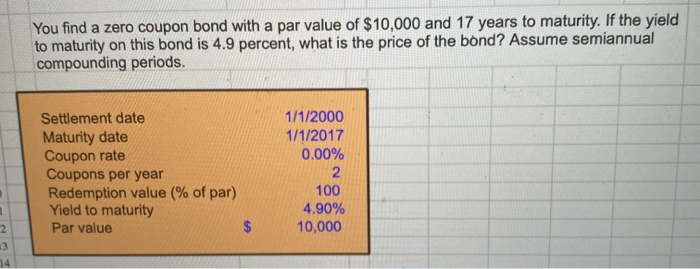

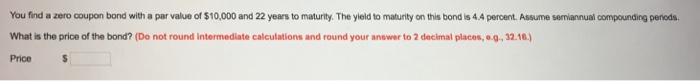

Yield to maturity of zero coupon bond. Chapter 6-Math Flashcards - Quizlet If an Allied Chemical zero coupon bond due in 12 years is selling for $420.00, what is its yield to maturity? a. 7.50% b. 4.64% c. 6.51% d. 5.26% a. 7.50% A General Electric 7½25 bond closed at 98. What is the current yield? a. 7.65% b. 7.81% c. 7.50% d. 7.34% a. 7.65% Penny Pincher Discount Grocers has an 11s 22 bond that closed at 102 3/8. Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that … Solved 15, A zero-coupon bond has a yield to maturity of 9 ... Transcribed image text: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16. Value and Yield of a Zero-Coupon Bond | Formula & Example Where yield is the periodic bond yield and n refers to the total compounding periods till maturity.. Yield on a Zero-Coupon Bond. Given the current price (or issue price) of a zero-coupon bond (denoted as P), its face value (also called maturity value) of FV and total number of n coupon payments, we can find out its yield to maturity using the following equation:

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds 1. What is the yield-to-maturity on a 15-year, zero ... What is the yield-to-maturity on a 15-year, zero coupon bond selling for $3857 The lae value is $1000 440 b. 5.60% c. 3.97% 6.67% e. 37.5% 12. What is the market value of a bond that has a coupon rate of 10% (paid semi-annually) if there are 20 years to maturity? Assume the bond has a $1.000 face value and an 8% yield to maturity or required ... 65 Calculate the yield to maturity of a zero coupon bond ... Calculate the yield to maturity of a zero coupon bond with a face value of $1000, maturing in 10 years and selling for a price of $529.30. a. 6.57% b. 8.45% c. 4.16% d. 10.23% e. 12.17% ANS: A Solve for i 1000 = 529.3 (1 + i) 10 i = (1000/529.3) 1/10 - 1 = .0657 a . 6.57 % Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

YIELDS TO MATURITY ON ZERO-COUPON RONDS - Bond Math Fourteen-year TIGRS are priced at $250 to yield 10.151% (s.a.). Such problems are easily solved using the time-value-of-money keys on a financial calculator or a spreadsheet program. In this chapter, I work with a 10-year zero-coupon corporate bond that is priced at 60 (percent of par value). Its yield to maturity is 5.174% (s.a.). Solved "A zero-coupon bond has a yield to maturity of 5% ... See the answer "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of __________ today. " Expert Answer 100% (1 rating) Bond price of zero coupon bond today = Matu … View the full answer Previous question Next question Yield to Maturity (YTM) - Overview, Formula, and Importance The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they can expect from each. It is critical for determining which securities to add to their portfolios. Answered: The yield to maturity on 1-year… | bartleby Transcribed Image Text: The yield to maturity on 1-year zero-coupon bonds is currently 5.5%; the YTM on 2-year zeros is 6.5%. The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 7.5%. The face value of the bond is $100. a.

A 12.25-year maturity zero-coupon bond selling at a yield to maturity of 8% (effective annual ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

A zero coupon bond has a yield to maturity of 12 and a par ... 105. You have just purchased a 7-year zero-coupon bond with a yield to maturity of 11% and a par value of $1,000. What would your rate of return at the end of the year be if you sell the bond? Assume the yield to maturity on the bond is 9% at the time you sell. A. 10.00% B. 23.8% C. 13.8% D. 1.4% E.

The following is a list of prices for zero-coupon bonds of various maturities. a. Calculate the ...

Bond Yield: Definition, Formula, Understanding How They Work The coupon yield — or coupon rate — is the interest you earn annually from a bond. For example, if you bought a bond for $100 and earned $5 in interest per year, that bond would have a 5% ...

What is the difference between coupon rate and yield to maturity? Why should they differ if I ...

Yield to Maturity Calculator (YTM Calculator) - YTM Formula The calculation of yield to maturity is quiet complicated, here is a yield to maturity formula to estimate the yield to maturity. Yield to Maturity (YTM) = (C+(F-P)/n)/(F+P)/2, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity. How to Calculate Yield to Maturity

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to maturity formula zero ...](https://www.yumpu.com/en/image/facebook/12426614.jpg)

[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to maturity formula zero ...

Zero Coupon Bond Yield Calculator - YTM of a discount bond Zero Coupon Bond Yield Calculator. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Calculator - What is the Market Price ... Benefits and Drawbacks of Zero Coupon Bonds. Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more ...

BAII Plus Bond Yield Calculations | TVMCalcs.com Current Yield; Yield to Maturity; Yield to Call; We will discuss each of these in turn below. In the bond valuation tutorial, we used an example bond that we will use again here. The bond has a face value of $1,000, a coupon rate of 8% per year paid semiannually, and three years to maturity. We found that the current value of the bond is $961.63.

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

The following is a list of prices for zero-coupon bonds of various maturities. a. Calculate the ...

Yield to Maturity (YTM) Definition - investopedia.com Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market price = 5.21%. To calculate YTM here, the cash flows must be determined first. Every six months...

Yield to Maturity Calculator | Good Calculators You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate. It also calculates the current yield of a bond. Fill in the form below and click the "Calculate" button to see the results.

Yield to Maturity (YTM) Definition & Example ... How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. The zero coupon bond formula is as follows: For instance, you want to invest in a $1,000 zero coupon bond that has three years until it matures. It's currently valued at $1,825.

How to Calculate YTM and effective annual yield from bond cash flows in Excel « Microsoft Office

en.wikipedia.org › wiki › Yield_spreadYield spread - Wikipedia It is also possible to define a yield spread between two different maturities of otherwise comparable bonds. For example, if a certain bond with a 10-year maturity yields 8% and a comparable bond from the same issuer with a 5-year maturity yields 5%, then the term premium between them may be quoted as 8% – 5% = 3%.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value.

Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

› bootstrapping-yield-curveBootstrapping | How to Construct a Zero Coupon Yield Curve in ... Now, for a zero-coupon with a maturity of 6 months, it will receive a single coupon equivalent to the bond yield Bond Yield The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price.

Post a Comment for "40 yield to maturity of zero coupon bond"